Estimated read time: 3-4 minutes

A three-year study conducted by Viacom shows just how much millennials hate their bank. One in three of them even said they were open to switching banks in the next 90 days.

According to Crew, a family banking app headquartered in Utah, 42% of their total deposits have come from customers leaving big banks like Chase, Bank of America, and Wells Fargo.

"It's clear that millennial parents are frustrated with traditional banks and are abandoning them for digital banking apps," says Gentry Davies, CEO of Crew.

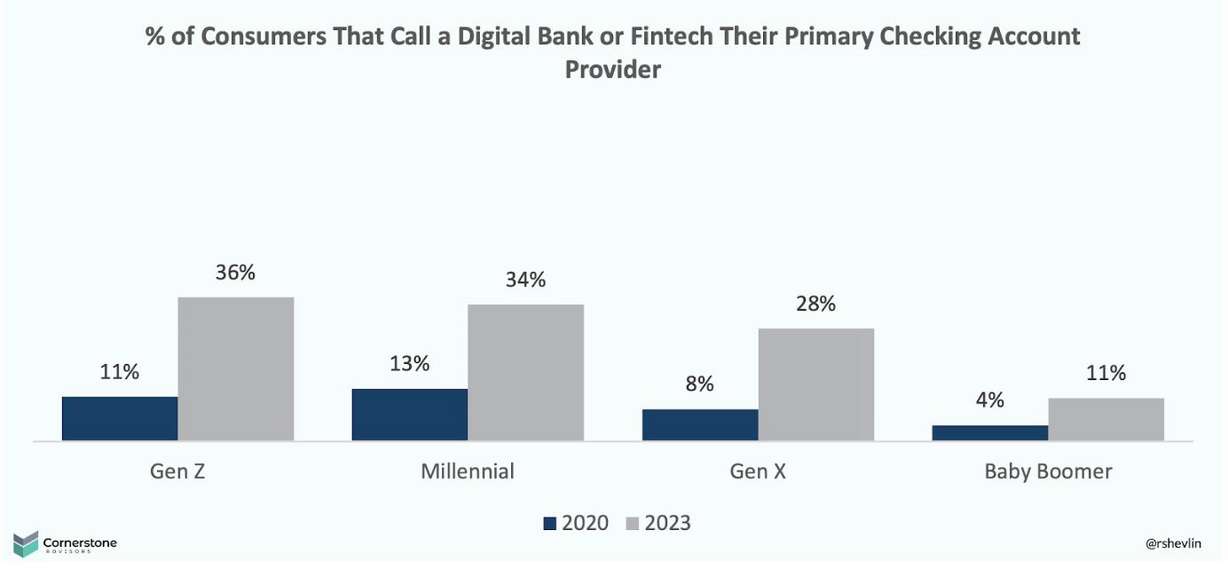

Cornerstone Advisors reports that almost half of the checking accounts opened in the US since 2020 have been at digital banks or fintechs, while only 20% have been at big banks. That's led to an increasing number of people who consider a digital bank as their primary checking account, including more than a third of millennials.

Millennials are abandoning traditional banks

"Many big banks seem to pride themselves on what I call 'customer no-service.' It's not a question of if, but when, you'll get ripped off by your big bank." – Clark Howard, author and personal finance expert. Here are some examples of more recent complaints:

- Low interest rates: Big banks are notorious for offering terrible interest on deposits - usually 0.01% APY.

- Account fees: Not only do big banks pay below-market interest for your deposits, they often charge all types of fees – account fees, overdraft fees, out-of-network ATM fees, wire transfer fees, and more.

- Poor customer experience: You'd think all those fees would allow big banks to provide a great user experience, but that's not the case. Big banks often have dated mobile app experience, and require you to come into a branch to accomplish basic tasks that should be easily done online.

- Poor family support: Traditional banks also make it difficult to open accounts for children. They often require you to visit the branch in person with both parents and the child to set up the account correctly and often have minimum age requirements. They also rarely provide meaningful tools to help parents teach their children financial skills.

What Millenials want from a bank

Millennial parents want a seamless digital experience that can support their entire family. This generation expects their bank to do more than just hold their money —they expect financial empowerment and education for them and their children.

Crew is the first banking app designed specifically for families. It provides powerful tools for parents and services to help them manage their kids' finances.

For Parents:

- Joint high-interest checking (0.5% APY) and savings (4.2% APY3) accounts.

- FDIC insurance up to $250k for single accounts and $500k for joint accounts.

- Cruise Control auto-account balancing to maximize interest and avoid overdrafts.

- Free cash withdrawals from any ATM.

- Free mobile wires (with deposits over $50,000)

- No international fees.

- A beautiful, intuitive, mobile experience.

For Kids:

- Easily create real checking and savings accounts for children (no age restrictions).

- Real high-interest bank accounts with account and routing numbers and direct deposit.

- Automatic allowances with built-in splitting between spending and savings accounts.

- Savings pockets with optional goals.

- Adapted child login so children can manage their own accounts.

- Parental controls to oversee child spending.

- Real-time spending notifications.

You can sign up for Crew today and get a 0.5% interest boost on your family's savings account with code KSLNEWS.

Crew is a financial technology company, not a bank. Banking services provided by Bangor Savings Bank, Member FDIC.

APY is variable and may change after account opening. The advertised 4.2% savings APY is accurate through Oct 31, 2024 and is subject to change at any time. There is no minimum balance or deposit required to obtain the advertised APY.